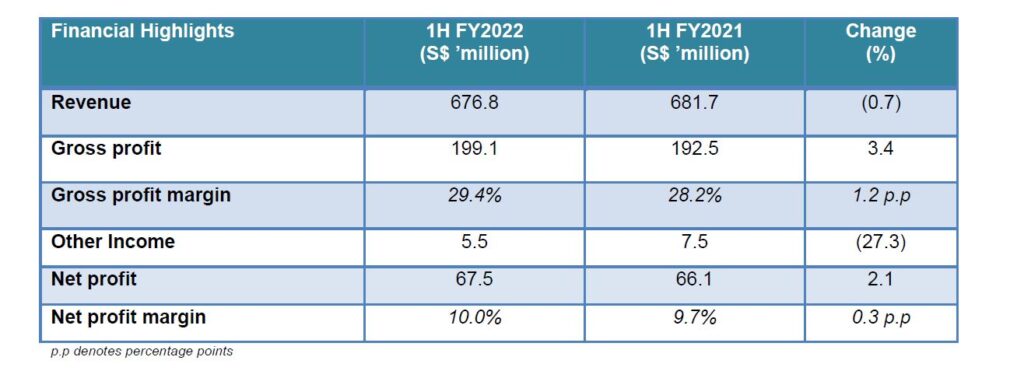

- Revenue decreased 0.7% yoy to S$676.8 million, largely attributed to the easing of pandemic measures and increased overseas travel

- Gross profit margin improved 1.2 percentage points to 29.4% from a change in sales mix

- The Group declared an interim dividend of S$0.0315 per share, an increase from S$0.031 for 1H FY2021

Singapore, 28 July 2022– Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported its financial results for the six months ended 30 June 2022 (“1H FY2022”).

Revenue decreased by 0.7% year-on-year (‘yoy’) to S$676.8 million as COVID-19 measures were lifted in 2Q FY2022 towards endemic living. This led to increased outdoor dining and overseas travel, especially during the June school holidays, which in turn returned sales revenue to more normalised pre-pandemic levels. Comparable same store revenue in Singapore decreased by 2.4% yoy, while new stores added 0.9% yoy to total revenue. Contribution to revenue from China increased by 0.8% yoy with the addition of 2 new stores in 2H FY2021.

Gross profit increased by 3.4% yoy to S$199.1 million despite the decline in revenue. Gross profit margin improved to 29.4% from 28.2% due to a change in sales mix.

Other income decreased to S$5.5 million, from S$7.5 million for 1H FY2021, mainly due to the reduction of government grants in light of the improved COVID-19 situation. The percentage of other income contributed by government grants reduced to 26.0% from 48.4% for 1H FY2021.

Administrative expenses increased by 2.3% yoy to S$115.9 million. Higher energy and other related expenses at its operating premises contributed to a bulk of the increment.

All in, the Group recorded a 2.1% yoy increase in net profit to S$67.5 million for 1H FY2022. Net profit margin also improved to 10.0% from 9.7% for 1H FY2021.

Total cash and cash equivalents stood at S$234.3 million as at 30 June 2022, compared to S$246.6 million as at 31 December 2021.

The Group is declaring an interim dividend of S$0.0315 per ordinary share, an increase from the previous interim dividend of S$0.031 per ordinary share.

Looking Forward

In that first half of 2022, Singapore lifted most of the COVID-19 restrictions, allowing any group size for dining, loosening mask-on requirements and removing work-from-home requirements. This encouraged residents to venture out for more dining options and have more activities out of their homes, normalising the demand for groceries and essentials.

The Omicron variant that started in November 2021, which remains influential till today in Singapore with derived variants, continued to drive case counts in 1H 2022. With the exceptional vaccination and booster rates in Singapore, these cases are muted in their severity, allowing Singapore to maintain the loosened restrictions. Barring any disruptions from new COVID-19 variants, the Singapore economy is on track for recovery with GDP growth at 4.8% for 2Q 2022[1].

The main concern for the remainder of 2022 is the global inflationary pressure driven by various factors such as supply chain disruptions and other macroeconomic factors. Expectations for inflation may have fallen to 3.9% for 2Q 2022[2] over dampened growth outlook, but is still higher than the historical average of 3.3% for the same quarter. Core inflation rate itself is the highest in 13 years at 3.6%[3]. All these point to a cautious spending outlook, where there may be belt-tightening from consumers to focus on essentials and to make price conscious choices. Consumers may prepare meals at home more frequently or look towards house brand products for affordable value products to ease inflation and wallets. The Group will continue to support its customers by working closely with suppliers to minimize supply chain disruptions and to assuage the pressures from rising costs with competitive prices and value-for-money products.

Mr Lim Hock Chee, the Group’s Chief Executive Officer, commenting on the future plans of the Group,“The Group continues to prospect for potential spaces, especially in new HDB estates where it does not have a presence. With the loosening of COVID-19 restrictions and the gradual recovery of the Singapore economy, construction of HDB projects is back on track[4] and bringing about more store-opening opportunities. The Group is also seeking to continuously improve on its operating efficiency and productivity to counter competition and rising costs from global inflationary pressures.”

[1] https://www.channelnewsasia.com/singapore/singapore-gdp-economy-second-quarter-q2-mti-advance-estimates-2808856

[2] https://www.businesstimes.com.sg/government-economy/singaporeans-inflation-expectations-ease-poll

[3] https://www.channelnewsasia.com/business/singapore-core-inflation-may-2022-food-prices-electricity-gas-2765346

[4] https://www.channelnewsasia.com/singapore/hdb-bto-flats-projects-median-waiting-time-desmond-lee-delays-2706036