- Revenue increased 2.7% yoy to S$337.5 million in 1QFY2021 despite comparison to a high base due to COVID-19 pandemic induced demand in 1QFY2020

- Growth in gross profit of 4.9% yoy to S$93.1 million outpaced revenue growth as gross margins improved due to better input prices

- Group remains conservative and expects 2QFY2021 revenue to be lower yoy as elevated demand peaked and the Group reported record revenue in 2QFY2020

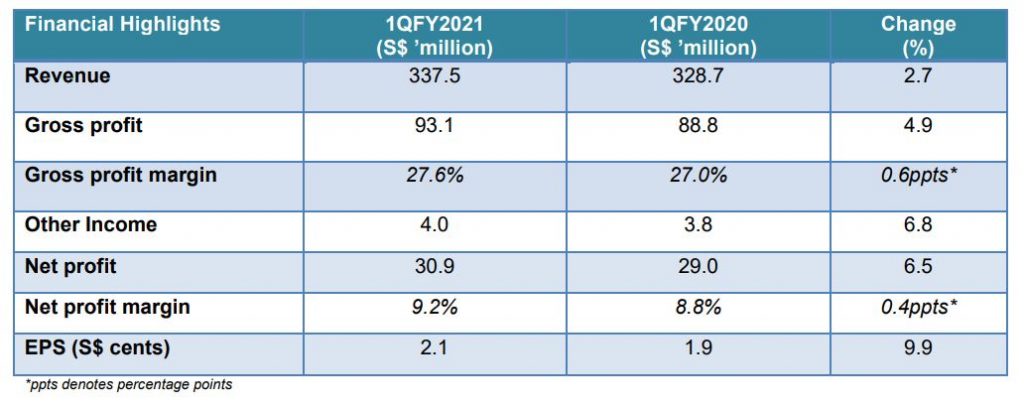

Singapore, 26 April 2021 – Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported a 6.5% year-on-year (“yoy”) increase in net profit to S$30.9 million for the 3 months ended 31 March 2021 (“1QFY2021”).

Despite higher Chinese New Year sales, revenue for 1QFY2021 increased slightly by 2.7% yoy, contributed entirely by growth in new stores. Comparable same store sale was flat yoy due to a high base effect resulting from an elevated demand in 1QFY2020 caused by COVID-19.

Gross profit grew by 4.9% yoy to S$93.1 million in 1QFY2021, outpacing revenue growth as gross margins improved by 0.6 percentage points to 27.6% in 1QFY2021. The improvement in gross margins was mainly due to lower input prices. Sales mix of fresh to non-fresh produce remained largely the same in 1QFY2021 compared with 1QFY2020.

Administrative expenses increased by S$1.8 million yoy to S$55.9 million in 1QFY2021. Out of this increase, S$1.5 million was due to higher staff costs from additional headcount needed to man the 3 new stores opened after 1QFY2020 and a higher bonus provision because of improved financial performance. The Group’s operating margin increased by 0.5 percentage points to 11.2% for 1QFY2021.

Cash generated from operating activities amounted to S$28.9 million in 1QFY2021, despite cash used for the payment of payables for the Chinese New Year supplies and accrued bonuses relating to FY2020. Cash used for capital expenditures in 1QFY2021 amounted to S$3.6 million, of which S$2.5 million was used for the supermarket operations and S$1.1 million was used for maintenance capex relating to the warehouse’s operations. The Group generated a net cash of S$17.5 million for 1QFY2021. Total cash and cash equivalent stood at S$271.4 million as at 31 March 2021 (compared to S$253.9 million as at 31 December 2020).

Looking Forward

In November 2020, the Group submitted tenders for two shops at Block 115A Alkaff Crescent and Block 610 Tampines North Drive that were unsuccessful. Since then, there could be a tender for a new shop soon as construction activities have not resumed fully. The Group did not open any new stores in 1QFY2021. We expect new tenders probably at an accelerated pace towards the end of 2021 and into 2022 as HDB clears the backlog. The Group will continue to search for new retail spaces in areas where it is yet to build a presence and to nurture the growth of its new stores and improve comparable same store sale.

Competition is expected to remain keen among the brick-and-mortar supermarkets and online players. Even though there were no serious disruptions to the food supply chain due to COVID-19, there are still risks of disruptions which may be caused by weather, geopolitical developments or breakdown in international shipment.

In line with the containment of COVID-19 infections as well as the progressive rollout of vaccinations in Singapore, the Group expects elevated demand caused by the pandemic to taper off. Consequently, we are expecting lower revenue in 2QFY2021 compared to 2QFY2020 as elevated demand peaked, we achieved a record revenue of S$418.7 million. Going forward, there will also be comparatively lesser COVID-19 grants and rebates as the pandemic situation improves.

On the future plans of the Group, Mr Lim Hock Chee, the Group’s Chief Executive Officer, added, “Even though we were not successful in our tenders for the two shops in Block 115A Alkaff Crescent and Block 610 Tampines North Drive, we continue to be on the lookout for new retail spaces, particularly where we have yet to build a presence.

The Group remains focused on its goal to expand its retail network and improving same store sale in Singapore and China. We will work on driving cost efficiencies, enhance gross margins by working towards a sales mix with a higher proportion of fresh produce and deriving more efficiency gains from the supply chain.”