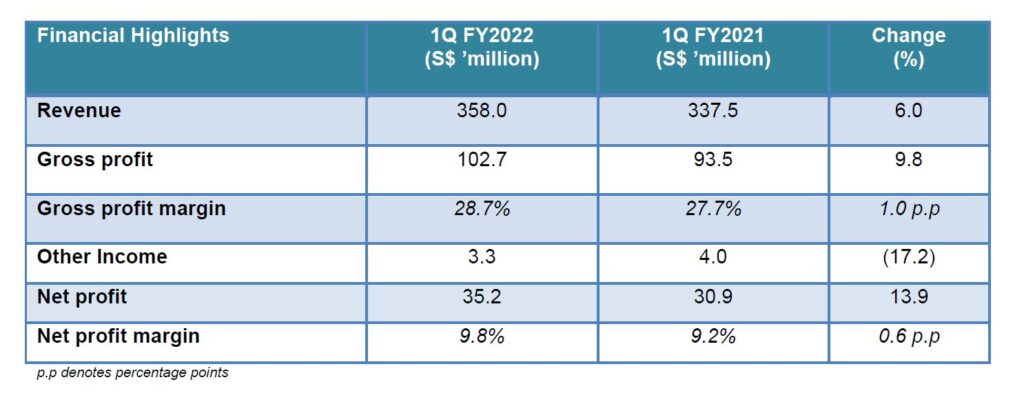

- Revenue for 1Q FY2022 grew by 6.0% yoy to S$358.0 million, contributed by new stores and comparable same store sales

- Gross profit increased by 9.8% yoy to S$102.7 million as margin improved to 28.7% due to higher revenue and a change in product sales mix change

- Targets to open 3 to 5 stores per year over the next three to five years

Singapore, 26 April 2022– Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported its financial results for the three months ended 31 March 2022 (“1Q FY2022”).

Revenue increased by 6.0% year-on-year (‘yoy’) to S$358.0 million. Comparable same store sales increased by 4.7% yoy in Singapore and 1.0% yoy in China respectively. New stores contributed 0.3% increment to the total revenue increase.

Together with the revenue increase, gross profit also increased by 9.8% yoy to S$102.7 million as gross profit margins improved by 1.0 percentage points to 28.7% in 1Q FY2022, arising from a change in sales mix.

Other income fell by S$0.7 million yoy to S$3.3 million in 1Q FY2022, as government grants received were reduced in pace with recovery from the pandemic. The percentage of other income contributed by government grants has fallen to 30.7% in 1Q FY2022 from 46.4% yoy.

Administrative expenses increased by S$3.0 million yoy to S$59.4 million in 1Q FY2022, due to a S$2.1 million increase in staff cost as raises were given to some of the staff in view of the tight labour market. An increase of S$0.9 million in depreciation of right-of-use assets were due to 5 new leases in year 2022.

As a result, the Group delivered a net profit of S$35.2 million for 1Q FY2022, an increase from S$30.5 million recorded a year ago. Net profit margin increased to 9.8% in 1Q FY2022 as compared to 9.1% in 1Q FY2021.

Cash generated from operating activities in 1Q FY2022 were S$21.7 million, down as compared to S$28.9 million a year ago, mainly due to higher cash outlay required to pay suppliers. Cash used in financing activities increased to S$13.4 million in 1Q FY2022, from S$7.5 million used in 1Q FY2021, due to a S$5.0 million repayment of term loan. A net increase of S$7.3 million of cash and cash equivalents were recorded for 1Q FY2022 with cash generated from operating activities outweighing cash used in investing and financing activities. Total cash and cash equivalents stood at S$254.0 million as at 31 March 2022 (compared to S$246.6 million as at 31 December 2021).

Looking Forward

In Singapore, most of the COVID-19 restrictions have been eased, including travel restrictions for vaccinated travellers. From 26 April 2022, group sizes were no longer capped, the need for safe distancing is not required and all may return to the office from the previous limit of 75% allowed. As such the elevated demand may further taper in 2022.

Although the outlook may look positive to society, it is necessary to remain cautious as these similarly optimistic views early 2021 were dampened by the new Covid-19 variants. There is still a risk of supply chain disruptions arising from any new COVID-19 variants, the growing climate concern and geo-political events. In addition, a major concern lies with the global inflationary pressure from the supply chain disruptions and other factors. When polled for inflation expectations in 1Q FY2022, Singaporeans are expecting a rate of 4.1% which is a 9-year high since 2012.[1] Total inflation has also recorded 4.2% in January and February of 2022, showing marginal difference between expected and actual inflation.[2]

Inflation is tied in deeply with the Group’s input cost and its customer’s spending. On the back of inflationary pressures, consumers are increasingly concerned with higher cost of living, and may choose to dine-in more at home, and look at ways to stretch their dollar. This may continue to support sales at the supermarkets. The Group will re-double its efforts in sourcing for differentiated and reliable supplies, working with its suppliers closely to reduce disruptions. The Group remains steadfast in ensuring the stability of the market with the supply of essential goods and to bring value to its customers with competitive pricing and affordable products.

On the expansion plans of the Group for 2022, Mr Lim Hock Chee, the Group’s Chief Executive Officer, added, “For the past two years, we have seen the supply of new HDB commercial space affected for various reasons, however this is expected to improve gradually. During the year 2021, we have successfully secured the leases of three stores. We target to open 3 to 5 new stores per year for the next three to five years, focusing in areas where we are not present.

For areas without the Group’s physical presence, we are continuing to build on our e-commerce capabilities to be able to provide to all our customers the same convenience of our products. All of our outlets, both existing and new are continuously monitored to maintain the performance for operational efficiencies and productivities.”

[1] https://www.businesstimes.com.sg/government-economy/singaporeans-expect-headline-inflation-will-rise-to-9-year-high-at-41-poll

[2] https://www.theedgesingapore.com/news/singapore-economy/mas-further-tightens-monetary-policy-settings-following-higher-inflation