- Revenue rose 7.1% yoy to S$764.7 million, driven by new store sales with gross profit margin improving 0.7 ppts attributed to better sales mix and efforts to mitigate rising operational costs

- Five new stores opened in 1H FY2025 with three additional new stores opening in 3Q FY2025. Tender results pending for three additional stores

- Positioned to benefit from government support measures and consumer preference for budget-friendly supermarkets amid macroeconomic uncertainties

- Maintains interim dividend of 3.20 Singapore cents per share

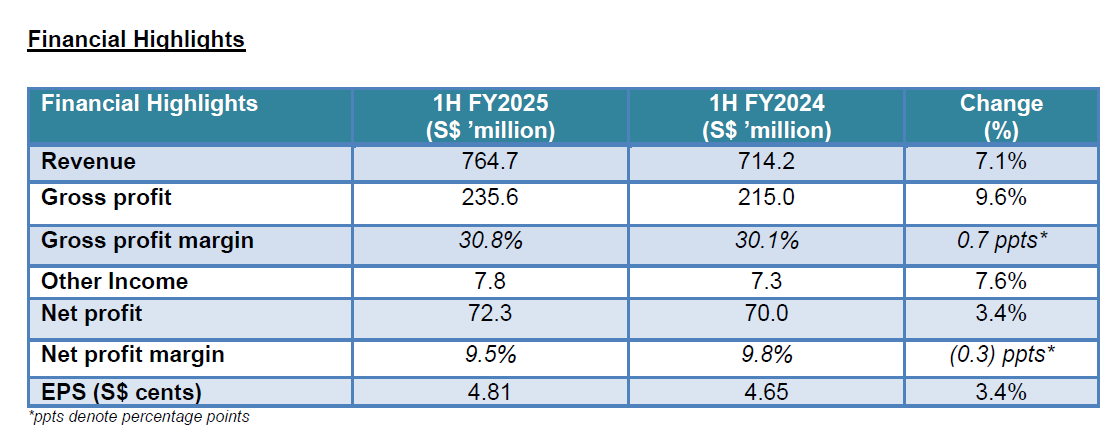

Singapore, 30 July 2025– Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported a net profit of S$72.3 million for the 6 months ended 30 June 2025 (“1H FY2025”), marking an increase of 3.4% year-on-year (“yoy”).

Revenue for 1H FY2025 rose 7.1% yoy to S$764.7 million, compared to S$714.2 million in 1H FY2024. This was mainly driven by the opening of eleven new stores in 1H FY2025 and the twelve months ended 31 December 2024 (“FY2024”).

Gross profit increased by 9.6% to S$235.6 million, compared to S$215.0 million in 1H FY2024 alongside an improvement in gross profit margin from 30.1% in 1H FY2024 to 30.8% in 1H FY2025. The improvement was mainly attributable to improvements in the sales mix while navigating the rising business operation costs.

Other income increased by 7.6% to S$7.8 million in 1H FY2025, supported by higher operating lease income and more government grants received.

Operating expenses recorded a yoy increase of 12.2% to S$158.7 million. This is driven by a 13.9% yoy increase in selling and distribution expenses to S$129.3 million in 1H FY2025, primarily attributed to an increase in number of employees from newly opened supermarket stores, and higher variable bonuses resulting from better financial performance.

Cash flow generated from operating activities decreased to S$86.4 million in 1H FY2025, compared to S$93.0 million in the same period last year. This was mainly due to increased funds utilised to settle outstanding payments to suppliers. The Group’s financial position remains strong with cash and cash equivalents of S$367.2 million in 1H FY2025, up from S$353.4 million as of 31 December 2024.

Correspondingly, the Board of Directors has proposed an interim dividend of 3.20 cents per share.

Looking Forward

Amid rising uncertainties and escalating tensions in the Middle East, Singapore’s core inflation dipped to 0.6% in May[1]. However, the ongoing US tariff war continues to weigh on the broader economic outlook. Against this backdrop, consumers are expected to remain cautious with their spending, preferring budget-friendly supermarkets and house brand products. Government support measures are expected to sustain consumer spending momentum and support supermarket sales.

At the same time, global geopolitical tensions, persistent trade disruptions, and extreme weather events continue to pressure supply chain, introducing risks such as price volatility, shipment delays, and shifting trade routes. The labour market also remains tight, with ongoing manpower shortages putting upward pressure on labour costs as businesses compete for qualified personnel. In addition, evolving regulatory requirements, including sustainability, climate reporting, and other regulatory requirements are expected to add to operational expenses.

To navigate this landscape, the Group will prioritise improving its sales mix while enhancing efficiency and productivity through technology enhancements, automation and supply chain diversification. The Group is actively pursuing expansion opportunities, particularly in areas where it currently has limited presence, and is awaiting tender results for three new stores. In China, competition in the supermarket sector remains keen. The Group will exercise prudence in opening new stores, with a continued focus on improving the performance of existing stores.

Mr Lim Hock Chee, the Group’s Chief Executive Officer, said, “Our performance remains underpinned by resilient earnings and margin growth, supported by prudent cost management to effectively navigate operational pressures. This financial discipline enables us to expand our store network in a sustainable manner, allowing us to better serve communities with our value-for-money proposition.

Backed by a store count of 82 as of July 2025, we will continue to prioritise expansion in areas where the Group has limited presence. In parallel, we remain focused on strategically tendering for new stores to further strengthen our presence and extend our reach to deliver sustainable value to our shareholders.”

– End –

[1] Source: https://www.straitstimes.com/business/economy/singapore-core-inflation-dips-to-0-6-in-may-reversing-rise-in-april