- Revenue rose 14.4% yoy to S$415.5 million, driven by new store openings and an improvement in comparable same store sales.

- Gross profit margin improved 0.2 percentage points yoy to 31.5% due to a better product mix.

- The Group opened four stores in 3Q FY2025, one store at Blk 221 Mount Vernon Rd in October, and plans to open another store at Leisure Park Kallang in 4Q FY2025.

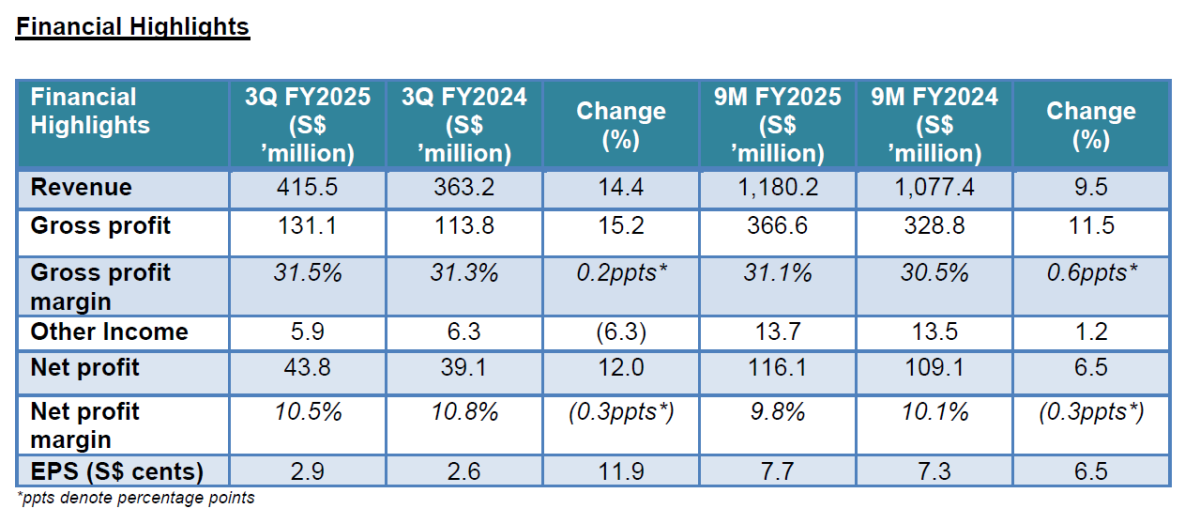

Singapore, 30 October 2025 – Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported a net profit of S$43.8 million for the 3 months ended 30 Sep 2025 (“3Q FY2025”), an increase of 12.0% year-on-year (“yoy”).

Revenue for 3Q FY2025 increased by 14.4% yoy to S$415.5 million, compared to S$363.2 million in 3Q FY2024. This growth was primarily driven by the net increase in total stores to 90, up from 79 in the same period last year. In addition, comparable same store sales improved by 4.4% on a yoy basis.

In line with the increase in revenue, the gross profit increased by 15.2% yoy to S$131.1 million in 3Q FY2025. The Group’s gross profit margin improved marginally by 0.2 percentage points to 31.5%, mainly attributed to continual improvements in the sales mix while navigating the rising business operation costs.

Other income for 3Q FY2025 decreased by 6.3%, mainly due to a decrease in government grants, as the Group received less grants under the Progressive Wage Credit Scheme (PWCS) for 9M FY2025.

Administrative expenses rose by 4.7% yoy to S$16.0 million in 3Q FY2025, while selling and distribution expenses increased by 17.3% yoy to S$69.3 million. These are primarily due to the increased number of employees to support the opening of new stores and higher variable bonuses resulting from the Group’s stronger financial performance. In addition, higher depreciation of the right-of-use assets from new supermarket leases entered in 9M FY2025 and FY2024 also contributed to the increase in expenses.

Cash flow generated from operating activities for 3Q FY2025 increased by 50.6% yoy to S$89.0 million, supported by higher profit reported and favourable working capital changes in this period. The Group ended the quarter with a solid cash and cash equivalents balance of S$393.7 million as of 30 September 2025.

Looking Forward

The Group expects grocery demand to remain resilient. Singapore’s Retail Sales Index rose 5.2% year-on-year in August, with Supermarkets & Hypermarkets up 8.7%, while Food & Beverage Services declined 0.4%1, indicating caution on out-of-home spending even as overall retail holds firm. Consumer spending in supermarkets and heartland shops continued to be supported by CDC and SG60 vouchers. However, competition within the supermarket and heartland retail segments remains intense and may exert pressure on margins.

Macro conditions are broadly supportive. Core inflation eased to 0.3% in August, and local interest rates have declined meaningfully since 20242, which should improve household cash flow. External risks, however, persist. US–China trade tensions continue to reshape supply chains and weigh on investment sentiment, with potential growth impacts expected in the second half of 2025.

In light of these developments, the Group remains cautiously optimistic and focused on providing our value-for-money proposition, which is likely to be favoured among consumers amid macroeconomic uncertainty.

At the same time, competition in Singapore’s supermarket industry remains intense. The labour market continues to be tight, and training and accreditation requirements under the Progressive Wage Model (PWM) continue to phase in, keeping manpower costs elevated. Furthermore, compliance costs relating to sustainability, climate reporting, and other regulatory requirements may increase operating expenses moving forward.

In response to these uncertainties, the Group will continue to diversify its supply chain to build resilience against external disruptions, optimise efficiency through automation and technology enhancements, as well as improve its sales mix to support sustainable growth.

Mr Lim Hock Chee, the Group’s Chief Executive Officer, said, “The Group’s results over the recent quarters are a testament to our resilience against economic uncertainties. In September, we accepted JTC’s offer to lease a new site at Sungei Kadut to establish a new distribution centre and headquarters. With an expected capacity to support 120 supermarkets, the new distribution centre marks a significant milestone to support our continued expansion.

The Group opened four stores in 3Q2025 and another store at Blk 221 Mount Vernon Rd in October, raising the total number of new stores opened in 2025 to 10, and the year-to-date store count in Singapore to 85. Looking ahead, we will continue to prioritise expansion in areas where the Group has limited presence, to extend our reach to customers and deliver sustainable value to our shareholders. Currently, one additional store at Leisure Park Kallang is scheduled to open in 4Q2025.

The Group will also continue to enhance operational efficiency, maintaining prudent cost management to navigate operational pressures.”

– End –

1 https://www.singstat.gov.sg/-/media/files/news/mrsaug2025.ashx

2 https://www.channelnewsasia.com/commentary/us-fed-cut-interest-rates-singapore-inflation-economy-5385076