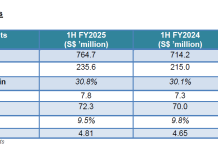

- Underpinned by a record half-yearly revenue in 1H FY2020, revenue for 1H FY2021 declined 8.8% on a high base effect to S$681.7 million

- Group delivered gross profit of S$192.5 million in 1H FY2021, gross profit margin improved by 0.6 percentage points to 28.2%

- The Group declared an interim dividend of S$0.031 per share, representing a dividend payout ratio of 71%

Singapore, 29 July 2021 – Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported net profit of S$66.1 million for the 6 months ended 30 June 2021 (“1H FY2021”).

The Group recorded revenue of S$681.7 million for 1H FY2021, an 8.8% year-on-year (yoy) decline from 1H FY2020 mainly due to a high base last year underpinned by an elevated demand arising from the government imposed ‘Circuit Breaker’ amid the Covid-19 pandemic.

In-line with lower revenue, gross profit decreased by 6.7% yoy to S$192.5 million in 1H FY2021, partially offset by improvement of gross profit margin. Gross margin improved by 0.6 percentage points to 28.2% in 1H FY2021 mainly due to favourable change in sales mix.

Administrative expenses decreased by 12.3% yoy to S$113.4 million in 1H FY2021. Out of this decline, staff costs fell by S$15.2 million in 1H FY2021 as the Group paid out higher bonuses and additional one-month salary (for all staffs except directors) to reward staffs on sterling sales performance in 2QFY2020.

Other income declined by 62.2% yoy to S$7.5 million in 1H FY2021.

Accordingly, the Group delivered a net profit of S$66.1 million for 1H FY2021, a 12.1% yoy decline from S$75.2 million recorded for 1H FY2020. In view of continued profitability, the Group has declared an interim dividend of S$0.031 per share for 1H FY2021 (1H FY2020: S$0.035 per share), representing a dividend payout ratio of 71%.

Cash generated from operating activities amounted to S$70.4 million in 1H FY2021 despite lower business volume and changes in working capital requirements. There are no major changes to the payment cycle. Cash used for capital expenditures in 1H FY2021 amounted to S$5.4 million and the Group made a partial repayment of term loan of S$10.0 million. Total cash and cash equivalent stood at S$248.0 million as at 30 June 2021 (as compared to S$253.9 million as at 31 December 2020).

Looking Forward

In view of the Phase 2 (Heightened Alert) imposed by the government from 22 July 2021 to 18 August 2021, it could result in a higher demand for our products as compared to the same period last year. However, as Singapore pivots from pandemic to an endemic approach in dealing with the virus and with the gradual easing of Covid-19 linked restrictions, the demand is likely to taper in the second half of 2021. Going forward, there will also be comparatively lesser government grants as the pandemic situation stabilises with higher vaccination rate.

Covid-19 has impacted the supply of new HDB shops amidst tight measures taken in 2020 to curb the spread of Covid-19. In 2021, there were a total of two tenders of which the outcome has not been announced. The Group will continue to search for new retail spaces in areas where it is yet to build a presence and to nurture the growth of its new stores and improve comparable same store sales.

The Group has also been successful in its expansion plans in China, having announced lease agreements for its third and fourth stores in China to nurture the growth of the supermarket operations in Kunming. The third store has a retail space of about 37,800 sq. ft. and is expected to be operational by the end of 3Q2021 while the fourth store has a retail space of about 30,772 sq. ft. and is expected to be operational by the end of 4Q2021.

Competition is expected to remain keen among the brick-and-mortar supermarkets and online players. Even though there were no serious disruptions to the food supply chain due to Covid-19, there are still risks of disruptions that may be caused by weather, geopolitical developments, or breakdown in international shipment.

On the future plans of the Group, Mr Lim Hock Chee, the Group’s Chief Executive Officer, added, “While our expansion plans in Singapore have been impacted due to the pandemic and the release of fewer tenders of new HDB shops, we continue to be on the lookout for new retail spaces, particularly in areas where we have yet to build a presence. Our expansion plan in China is also moving forward, having recently announced that we have signed lease agreements to set up two new stores in China.

The Group will also remain focused on improving same store sales in Singapore and China, working to drive cost efficiencies, enhance gross margins by working towards a favourable sales mix. In appreciation to our shareholders, the Group has also declared an interim dividend of S$0.031 per share.”