- The Group’s operating costs increased due to a S$11.3 million increase in administrative expenses driven by a rise in utility and staff costs.

- Net Profit after tax for 1H FY2023 decreased by 2.9% yoy with net margin reducing marginally to 9.5% from 10.0%.

- Proposed interim dividend of 3.05 cents per share for 1H FY2023.

- In line with its store expansion strategy, the Group continues to be on the lookout for viable retail space in new and existing housing estates.

Singapore, 27 July 2023– Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported a net profit of S$65.5 million for the 6 months ended 30 June 2023 (“1H FY2023”), a decrease of 2.9% year-on-year (“yoy”).

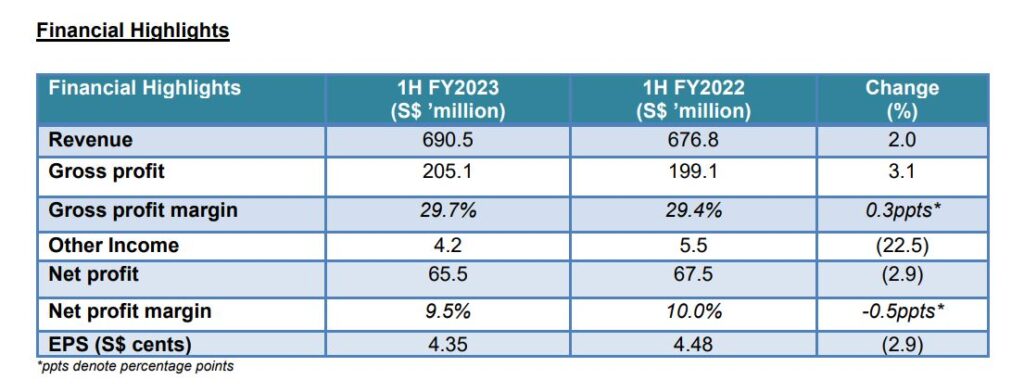

Revenue for 1H FY2023 increased by 2.0% yoy to S$690.5 million, compared to S$676.8 million in 1H FY2022. This increase is primarily driven by a 3.3% higher sales contribution from the 5 new stores compared to the corresponding period last year. Gross profit remained stable at S$205.1 million, compared to S$199.1 million in 1H FY2022. Gross margin improved by 0.3 percentage points yoy to 29.7% in 1H FY2023, mainly due to an improved sales mix of products with higher margins.

Other income declined to S$4.2 million in 1H FY2023 from S$5.5 million in 1H FY2022, mainly due to reduced government grants and scrap material sales.

In 1H FY2023, higher operating expenses were incurred due to a 9.8% yoy increase in administrative expenses. Under administrative expenses, staff costs increased by S$6.1 million yoy due to increased salaries in the tight labour market while utility expenses increased by S$5.8 million yoy in line with the Group’s electricity supply agreement that was renewed at a higher prevailing market rate at the end of FY2022.

As a result, net profit for 1H FY2023 decreased by 2.9% yoy compared to S$67.5 million in 1H FY2022. Net profit margin decreased marginally to 9.5% in 1H FY2023 compared to 10.0% in 1H FY2022.

In 1H FY2023, cash flow from operating activities increased to S$77.8 million compared to S$60.1 million in the same period last year where more funds were used to pay current liabilities. The Group’s cash position continues to remain strong with a cash and cash equivalents balance of S$289.0 million as at 30 June 2023.

Following the resilient financial performance, the Board of Directors has proposed an interim dividend of 3.05 cents per share, representing a dividend pay-out ratio of 70.0%.

Looking Forward

High inflation, geo-political tensions, debt vulnerabilities and supply chain challenges continue to cause economic uncertainty and threaten global growth. While global headline inflation seems to have peaked[1], it remains higher than central bank targets and the risk of a recession continues to loom.

Singapore, being heavily reliant on imports for its essential goods, continues to feel the impact of high inflationary pressure and price hikes seen worldwide in terms of food, energy and accommodation. Additionally, threats to the global supply of produce like fresh pork, sugar and rice[2] coupled with agricultural disruptions and reduced harvests induced by climate change and the onset of El Nino weather, are putting an upward pressure on food prices[3].

In light of these tight economic conditions, consumers may choose the relatively budget-friendly alternative of buying groceries and dining at home as compared to eating at restaurants. This may drive house brand sales going forward and improve margins as consumer preferences lean towards more value offerings. Moreover, the Singapore Government’s inflation offset measures, such as the GST Voucher scheme and the Assurance Package, continue to support consumer spending, giving supermarket retailers a boost.

Competition in the supermarket industry is expected to remain keen with higher operating expenses in terms of energy and staff costs affecting margins negatively. The Group will explore potential technologies to improve productivity and focus on strengthening its core competencies to improve its overall operational efficiency.

Mr Lim Hock Chee, the Group’s Chief Executive Officer, said, “The Group remains committed to bringing value-for-money offerings to its consumers. We strive to meet consumer expectations through competitively priced products with consistent quality and customer service. The Group is managing risks by diversifying its sources of supply and strengthening business ties with existing suppliers. Additionally, our expansion strategy remains intact as we seek to open stores in new and existing housing estates, capitalising on the rising number of HDB projects in the near future.”

– End –

[1] https://www.straitstimes.com/asia/se-asia/drought-menacing-thailand-threatens-global-supply-of-sugar-rice

[2] https://www.bloomberg.com/news/articles/2023-07-13/india-considers-banning-most-rice-exports-as-local-prices-surge

[3] https://www.imf.org/en/Blogs/Articles/2023/07/13/weak-global-economy-high-inflation-and-rising-fragmentation-demand-strong-g20-actio