- Revenue is down 2.2% yoy from the high base in 2021, despite the net increase of 3 stores in Singapore in FY2022.

- Gross profit margin and net profit margin for FY2022 grew by 0.7% and 0.3% respectively driven by a favorable sales mix of products with higher margins.

- Proposed final dividend of 3.07 cents per share, total dividend of 6.22 cents per share for FY2022.

- The Group continues to be committed to growth through new store openings.

Singapore, 27 February 2023– Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported its financial results for six months (“2H FY2022”) and twelve months (“FY2022”) ended 31 December 2022.

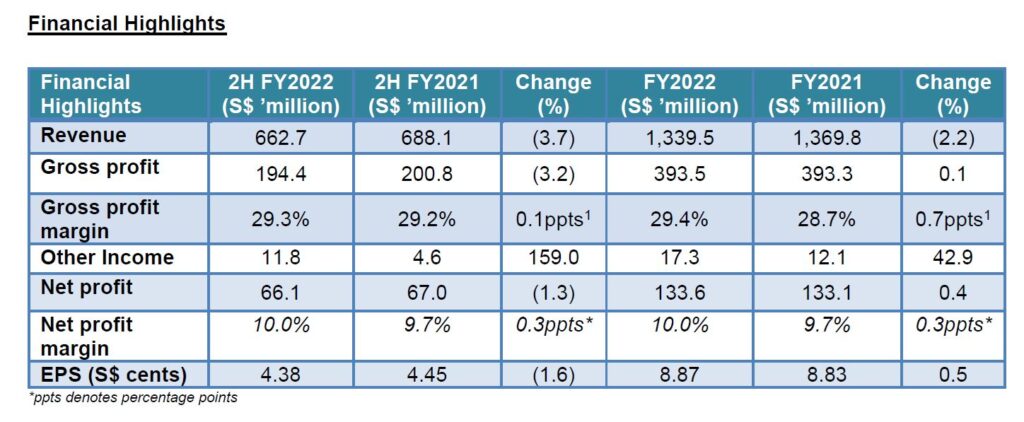

Revenue for FY2022 declined by $30.3 million to S$1.3 billion, a 2.2% yoy decrease on the back of continued normalisation that was driven by the significant easing in mobility restrictions starting 1 April 2022. Comparable same store sales in Singapore declined by 4.8% yoy, partially offset by a 2.1% contribution from the 5 new stores – 1 opened in end FY2021 and 4 in FY2022.

Despite a decline in revenue, the Group achieved higher margins. Gross profit margin increased marginally by 0.7 percentage points to 29.4% in FY2022 compared to FY2021. Similarly, net profit margin increased by 0.3 percentage points to 10.0% in FY2022 compared to FY2021. This can be attributed to an improved sales mix of products with higher margins.

Other income for FY2022 increased by 42.9% yoy to S$17.3 million due to one-off recognition of rebates from suppliers. The Group delivered a higher net profit of S$133.6 million for FY2022, 0.4% more compared to FY2021.

Administrative expenses increased by S$6.0 million yoy to S$236.2 million in FY2022, largely due to a S$2.8 million increase in rental, utilities, cleaning expenses and stamp duty. Operating costs rose due to premise and staff costs. Premise-related costs made up 45% of the total increment with the depreciation of right-of-use assets increasing due to a total of 24 new leases being signed in FY2022. For staff costs, the adoption of the Progressive Wage Model (PWM) since 1 September 2022 led the Group to allocate a higher portion of the annual wage to the fixed component from the variable, thereby increasing staff cost by S$2.1 million in 2H2022 compared to 2H2021.

Cash generated from operating activities in FY2022 were S$166.8 million, as compared to S$172.7 million in FY2021 mainly due to higher working capital requirements. To support the Group for expansion and potential contingencies, the Group has maintained a strong balance sheet position with a cash balance of S$275.5 million as at 31 December 2022, compared to S$246.6 million a year ago.

Following the resilient financial performance, the Board of Directors has proposed a final dividend of 3.07 cents per share. Together with the interim cash dividend of 3.15 cents per share, the Group will be paying out a total cash dividend of 6.22 cents per share to shareholders in FY2022 (FY2021: 6.20 cents per share), representing a dividend pay-out ratio of 70.0%.

Looking forward

Most countries, including China, have shifted to adopting an endemic approach to COVID-19, reducing COVID-19 related restrictions to a minimum. Singapore itself decided to remove all COVID-19 border measures from 13 February 2023 as the country steps down the DORSCON alert to its lowest level[1]. Sales are expected to continue to taper to more normalised levels.

On the other hand, inflationary pressures are expected to continue into 2023 and further restrict consumer spending. Singapore’s headline and core inflation are expected to average 5.5%-6.5% and 3.5%-4.5% respectively for 2023[2], which is relatively higher than the 2021 average. This may drive house brand sales going forward and improve margins as consumer preferences lean towards more value offerings. Operationally, inflation and the energy crises caused the cost of utilities to peak in 3Q2022 and are expected to remain at comparatively elevated levels in 2023.

Overall, tighter financial conditions, geopolitical tensions and trade conflicts across most developed economies are expected to continue to impact the global economy and supply chains. Further hikes in global interest rates could weaken the Singapore dollar and hence boost import costs.

Competition in the supermarket industry is expected to remain keen among both brick-and-mortar stores and online markets, particularly in this heightened inflationary environment. For Sheng Siong, the recent Budget 2023 announcement of inflation offset measures, such as the GST Voucher scheme and the Assurance Package, are expected to support consumer spending[3], and the growing supply of new HDB flats is expected to support the new store openings. The Group will continue to look out for retail spaces in new and existing HDB housing estates, particularly in estates where the Group has no presence

On the future plans of the Group, Mr Lim Hock Chee, the Group’s Chief Executive Officer, said, “Sheng Siong has been able to successfully navigate through volatile economic and political conditions to deliver consistent results. While sales continue to normalise from the effect of the pandemic, the current inflationary environment presents us with a unique opportunity to tap on consumer behaviour towards saving costs with our value-for-money proposition. However, we are aware of the challenges that may impact our operations and increase costs going into 2023, creating margin pressures.

The Group will continue to monitor global developments closely and, at the same time, look to enhance internal performance and increase the productivity of new and existing stores. More importantly, the Group remains committed to growth through an increased number of stores. In line with this, we already secured retail space for a new store to be opened in March 2023 in Singapore and signed a lease agreement for our 5th store in Kunming, China.”

– End –

[1] Ministry of Health Singapore, Singapore to exit acute phase of pandemic: https://www.moh.gov.sg/news-highlights/details/singapore-to-exit-acute-phase-of-pandemic

[2] Ministry of Trade and Industry Singapore, Consumer Price Development in December 2022: https://www.mas.gov.sg/-/media/mas/epg/cpd/2022/inflation202212.pdf

[3] The Business Times, Budget 2023: Boost to Assurance Package, GST voucher scheme to target rising cost of living: https://www.businesstimes.com.sg/singapore/budget-2023-boost-assurance-package-gst-voucher-scheme-target-rising-costliving#:~:text=Individuals%20living%20in%20homes%20with,of%20up%20to%20S%2421%2C000.