- The Group’s operating costs increased due to a 10.2% yoy increase in administrative expenses driven by higher staff and utility costs.

- Net Profit after tax for 3Q FY2023 increased by 2.9% yoy with net margin reducing marginally to 9.8% from 9.9%.

- In line with its store expansion strategy, the Group continues to be on the lookout for viable retail space in new and existing housing estates.

Singapore, 26 October 2023– Sheng Siong Group Ltd. (“Sheng Siong”, together with its subsidiaries, the “Group” or “昇菘集团”), one of the largest supermarket chains in Singapore, reported a net profit of S$33.8 million for the 3 months ended 30 September 2023 (“3Q FY2023”), an increase of 2.9% year-on-year (“yoy”).

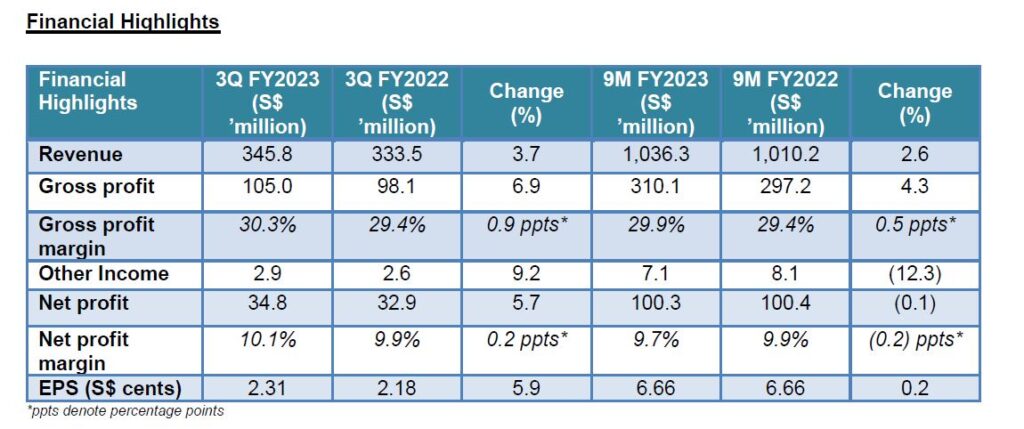

Revenue for 3Q FY2023 increased by 3.7% yoy to S$345.8 million, compared to S$333.5 million in 3Q FY2022. Sales contribution from the 6 new stores increased by 2.4% while that for the comparable same stores grew by 1.4%, as compared to the corresponding period last year. In line with the increase in revenue, gross profit increased by 6.9% to S$105.0 million, compared to S$98.1 million in 3Q FY2022.

The Group’s margins remained relatively stable in 3Q FY2023 with gross margin improving by 0.9 percentage points yoy to 30.3% due to continual improvements in sales mix. Net margin reduced by a marginal 0.1 percentage point yoy to 9.8%.

Other income increased by 9.2% yoy to S$2.9 million in 3Q FY2023 from S$2.6 million in 3Q FY2022, partially due to higher government grants.

In 3Q FY2023, administrative expenses increased by 10.2% yoy due to a S$2.2 million yoy increase in staff costs owing to a tight labour market and a S$3.9 million yoy increase in utility expenses according to the Group’s revised electricity supply agreement that was renewed at a higher prevailing market rate at the end of FY2022.

In 3Q FY2023, cash flow from operating activities increased by S$4.2 million yoy to S$54.9 million. The Group reported a strong cash and cash equivalents’ balance of S$289.2 million as at 30 September 2023.

Looking Forward

The streak of challenging economic and geo-political conditions has continued through most of 2023 and global economies are expected to continue to implement tight fiscal and monetary policies to manage high inflation, weak consumer demand and prolonged supply chain disruptions. The recent Israel-Hamas conflict that broke out in early October 2023, if exacerbated, has the potential to further disrupt the world economy and even cause a recession[1].

Singapore, as an import-reliant nation, continues to be sensitive to global price movements and trade restrictions like the unprecedented rice export ban implemented by India in September 2023[2]. Additionally, climate-related risks and the onset of El Nino weather pattern are set to threaten agriculture yields, potentially driving up food prices due to reduced harvests and more expensive animal feed.

The GST hike and carbon tax increase to be implemented in Singapore in 2024 will continue to put an upward pressure on consumer prices[3] inducing consumers to opt for more budget-friendly alternatives where possible. These may include buying groceries for home-cooked meals as compared to eating out at restaurants. This may translate to higher sales for the more affordable house brands going forward as consumer preferences lean towards value offerings. To further support the consumers, the Singapore Government announced a new Cost-of-Living support package in addition to the existing Assurance Package[4]. These packages continue to support consumer spending and give supermarket retailers a steady boost.

Competition in the supermarket industry is expected to remain fierce with active promotions being conducted by competitors. This coupled with higher energy and staff costs may put a downward pressure on margins. The Group will explore potential technological improvements and focus on strengthening its core competencies to improve overall operational efficiency and productivity.

Mr Lim Hock Chee, the Group’s Chief Executive Officer, said, “The Group has exhibited resilience in the midst of extreme economic uncertainty and remains committed to bringing value-for-money offerings to its consumers at competitive prices. The Group is managing risks by diversifying its sources of supply and strengthening business ties with existing suppliers.

In line with our expansion strategy in Singapore, we continue to seek store space in new and existing housing estates, capitalising on the rising number of HDB projects in the near future. Additionally, the Group recently announced the signing of a lease to open its 6th store in Kunming, China which is expected to be operational by the middle of 2024. Our operations in China continue to remain profitable.”

– End –

[1] https://www.bloomberg.com/news/features/2023-10-12/israel-hamas-war-impact-could-tip-global-economy-into-recession

[2] https://www.businesstimes.com.sg/opinion-features/columns/rice-price-surge-highlights-long-term-climate-risks

[3] https://www.straitstimes.com/business/singapore-core-inflation-drops-for-4th-straight-month-to-34

[4] https://www.channelnewsasia.com/singapore/cash-payouts-cdc-vouchers-singaporeans-cost-living-water-prices-3804691